If you are like most people, you are more than likely overpaying on your car loan. Whether you got talked into a higher APR at the dealership, or your credit has simply improved, chances are there are lower rates out there that could be saving you loads of money every month. But don’t just take our word for it–in this article we will look at how auto refinance works and discuss why you should consider refinancing your vehicle.

Refinancing is when you pay off your existing loan with a new loan that ideally has better terms. Auto refinance will get you out of the current financing relationship that you are in and let you start over with different terms that can change your APR, repayment terms, penalties, and other miscellaneous conditions of your loan. There are many reasons that auto refinance can benefit you.

Like a lot of things in life, timing is everything. It is important to keep this in mind when you are thinking about refinance. Auto loan refinancing is certainly more beneficial at certain times than at others.

You are allowed to refinance at any point in your loan. You will however need to wait for any paperwork to be finalized on your initial loan, which can take anywhere from 30 to 90 days. But once everything is signed and filed, you are able to refinance.

Experts recommend waiting 6-12 months before refinancing. There are a few reasons for this. First of all, this will give your credit score a chance to recover from the hard inquiries of your initial loan. When you apply for a new line of credit, your score will take a slight hit. It is best to wait until your score recovers from this. The better your credit score is, the better APR you will be offered. The second reason you should 6-12 months is to give yourself time to make consistent, on-time payments. If you can make full and timely payments on your auto loan, this will help improve your credit score. Again, the better your credit score, the better the APR you are offered will be.

There is definitely a sweet spot in your car financing timeline to think about auto refinancing.

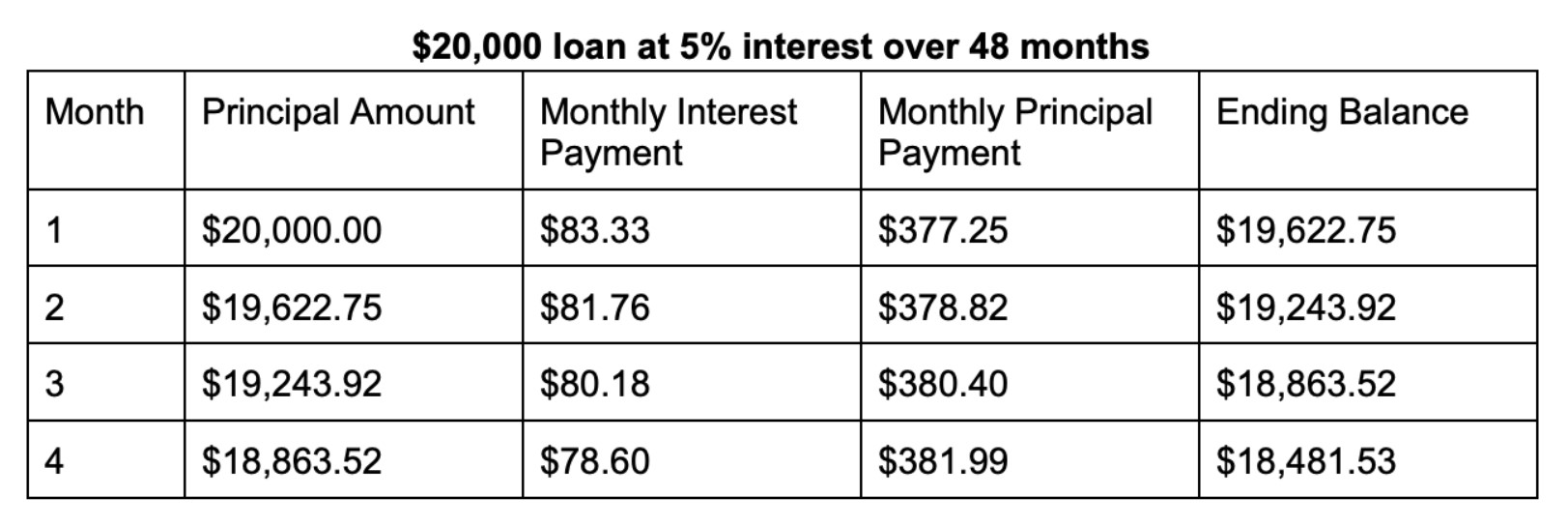

Car loans are amortized and “front-loaded”, which means that in the beginning your payments aren’t split evenly between your interest and your principal. Instead, you pay off more of the interest in the beginning than you do the principal. Let’s look at an amortization schedule to see how the first four monthly payments are divided.

As time goes on, you pay less and less towards the interest and more and more towards the principal.

This means that towards the end of your loan, you are mostly paying the principal and little of the interest. When you refinance, the money you are hoping to save comes from the savings in interest payments. So it is more beneficial to refinance when you have at least a year (preferably two years) left on your loan payments. This will make it the most beneficial for you.

Aside from saving money (which is probably reason enough), what are the other benefits to auto refinancing?

For many, reducing monthly payments is a huge benefit. Even if you do not secure a substantially lower APR, refinancing allows you to change your repayment plans and stretch your payments over a longer period of time, which can loosen up your monthly budget significantly.

Refinancing is also the only way you can add or remove a co-borrower from your vehicle. Whether you want to add your child on as a co-borrower to help them build credit or remove a co-borrower because you no longer need their financial assistance, refinancing is the way to achieve this.

When you decide to pursue an auto loan refinance, you may be wondering what the risks are. Just as there are good times to refinance, there are also bad times when it will not make as much sense for you. So when is it a bad time to refinance and when do the risks outweigh the benefits?

If your credit score has recently decreased, there’s a good chance you won’t be eligible for a lower APR. Maybe your credit score dropped because you have recently opened other accounts or you hit a rough patch and were not able to make consistent on time payments. No matter what the reason is, a lower credit score may make refinancing less beneficial.

The APRs that are offered are dictated in part by the market rates. If your prevailing interest rates are higher than when you originally financed your vehicle, you will most likely not find a better APR.

A major risk of refinancing is the prepayment penalties to which you may be bound. Read your loan contract carefully to determine what penalties you may have to pay if you choose to leave your lease early. The amount you will pay in penalties may outweigh your savings.

As you near the end of your loan your payments will go against the principal more than the interest. You will ultimately not save much by lowering the APR, and you may not qualify for refinancing if the repayment term left is short.

If you are trying to apply for a mortgage or need a high rating for another reason, remember that refinancing will cause a slight dip in your score. Refinancing will cause a hard inquiry into your account as well as change your credit history. While these shouldn’t be drastic hits, if you are applying for a mortgage it may cost you a slightly higher APR for that account.

If your car has deprecated a good deal you may not qualify for refinancing. Depreciation can occur for a number of reasons:

Mileage. The more you drive your car, the more it depreciates. High mileage shortens the amount of usable time left on the car.

Age. The older a car is, the less it’s worth. Even if it still drives perfectly, the fact that it is an older model will reduce the value.

Make and Model. If you are driving a more popular model, your car will depreciate slower. Value is based on how much someone is willing to pay. The more people want your car, the more they will pay for it. If you have a less desirable car, expect your car to depreciate at a faster rate.

Condition. If your car has been in a few accidents or hasn’t been consistently maintained, it’s value may be depreciated.

If depreciation lowers your car value significantly, refinancing might not be an option for you.

If auto refinance sounds like it might be a good option for you, you now need to figure out when you can find the best auto refinance rates. It is incredibly important to shop around for rates when you are looking to refinance. You should do research to determine what your options are, trying to select 3-5 lenders to apply to. You will not have a good idea of what the terms are or what APR you qualify for until you actually apply.

The most efficient way to shop around and find the best auto refinance rates is to use a company that will do the legwork for you. Companies that specialize in auto refinance, like Auto Approve, have editing relationships with lenders and can streamline the application process for you. By simply filling out an online quote form, they can get you a quote in minutes. They can handle all of the paperwork too (yes, even the DMV forms).

When looking for a lender, you want someone that you can trust. With an A+ rating from the Better Business Bureau and a 96% would-recommend rating from TrustPilot, you don’t need to take it from us. Our customers know that we find the best auto refinance rates and will never markup the prices–we pass the savings on directly to you.

There are so many benefits to vehicle refinancing, from allowing you to lower your APR to reducing your monthly payments. Still have questions? Contact us today to get started!