In the United States, 25% of people choose to lease their cars rather than financing them. While there are a lot of benefits to buying a car, car leasing is popular for a lot of reasons. Popular reasons for leasing include:

Lower monthly payments

Less cash required upfront

Lower maintenance costs

New car every few years

No need to sell it when you want something new

When your lease ends, you have three options. You can return your car and lease another one, you can return your lease and walk away entirely, or you can purchase your leased car from the dealership. So how do you know what the right choice is?

It can be hard to find a car we love–one that drives well, looks nice, and is comfortable to be in. After spending two or three years in your lease, you may not be inclined to just give it back. So the good news is that most lease agreements will allow you to purchase your leased car for a specified amount.

When you buy out your lease, your car will officially be yours. No more mileage allowances or restrictions on customization. You are free to do what you like. So if you really like your car, a lease buyout might be right for you.

The buyout price of your car is based on the following factors:

The residual value of your car, as listed in your contract

Any remaining payments (you can buy your leased car at any point in your lease)

Any applicable fees

Sales tax

The most important factor is the residual value. What is residual value on a car lease? It is the anticipated value of your car at the end of the lease period. The residual value is always determined ahead of time and cannot be negotiated, even if the residual value listed in the contract differs greatly from the actual market value of the car.

Used cars are in high demand in this current auto market. High demand for new cars and a shortage in car production due to a variety of reasons has increased the demand for used cars as well. This means that used cars have a higher market value now than they have had in the past. So chances are your car’s residual value is much less than the market value.

If you love your car, this means that you can buy it at a great price. If you don’t love your car, it means that you can buy it at a lower price and sell it for a profit. Either way, if your car’s residual value is less than the market value–which you can check on Kelley Blue Book or Edmunds–it’s a good idea to buy out your car lease.

Leasing a car is essentially renting a car from a dealership. Because you do not own it, they will put mileage restrictions to ensure that you are not overusing the car (and thus devaluing the car). These mileage restrictions are usually around 12,000 miles per year. For some people that is totally reasonable, and they won’t even come close to hitting that. But for others who have longer commutes or have longer trips that they make regularly, this mileage allowance isn’t nearly enough.

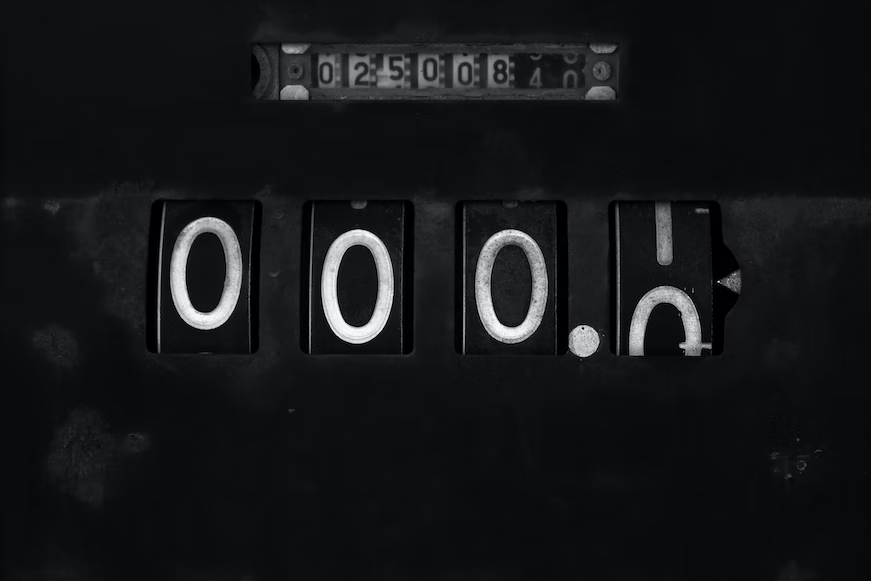

Mileage fees vary greatly from dealer to dealer and from car model to car model. They can range from $.15 per mile to $.30 per mile that you go over the limit. And this can add up to a lot of money. With a $.25 mileage fee and 3000 extra miles per year over three years, this is over $2,000 in fees that you will have to pay the dealer.

If you choose to buy your car lease you will not be responsible for the mileage fees. The $2,250 you owe can be put towards buying your car and getting equity. So don’t waste your money on fees, buy your lease out instead.

The residual value of your car is based in part on how many miles it will have on it at the end of the lease period. Since you are paying for a set usage (let’s say 12,000 miles per year), if you don’t use that amount by the end of the lease, your car should be worth more than the listed residual value. Chances are your car will be worth more than you will pay for it, so it is a good investment to buy your leased car if you are significantly under the mileage allowance.

Again, leasing is renting. Dealers want to ensure that you aren’t going to damage the car that they are renting to you. To help curb this they will have different levels of wear and tear that are acceptable when you return your car.

In general small scratches and dings are expected. But once they become larger and more prominent, these bumps and dings will start to add up. Excessive wear and tear can include:

Large dents

Cracks in glass

Stains on the upholstery

Tears in the upholstery

Poor-quality repairs

When you return your lease they will do a thorough inspection of your car and determine if there is any excessive wear and tear. If there is, these fees can add up fast. Instead of spending money on fees to the dealership, you can spend that money on buying your leased car.

If you’ve seen one or more of the above signs, a lease buyout may be a great option for you. And the best news? It’s super easy to buy out your car lease. Here are the steps for buying out your car lease.

Be sure to read your current lease agreement closely to determine if you are able to purchase your lease and how much you will need to pay for your lease buyout. If you are unsure, you can call the dealership to get a total cost. Your lease buyout price will be based on the residual value plus any additional fees.

If you know that you will need a loan to purchase your lease, make sure you are in the best position possible to do so. You will qualify for the best car loan APR by having a strong credit score. You can strengthen your credit score by doing the following in the months leading up to your car lease buyout loan applications:

Make full and on time payments on all of your accounts

Request a copy of your credit report and review for errors

Request higher limits on your credit accounts

Pay off debts that have a high credit utilization ratio

Hold off on opening any other new accounts

A little boost to your credit score can result in much better car loan APRs, so it’s worth it to put in a little extra effort before applying.

If you are able to buy your car in cash, then this will be simple. But for most people, this will entail finding a car lease buyout loan. Finding a car lease buyout loan is easy when you use a company that specializes in buyout loans. If you are looking for a loan, you want to do your research and find the best lender for you. You should apply to 3-5 lenders and be sure to compare the following terms when the offers start coming in:

Car loan APR

Repayment period

Customer service ratings

Additional fees

Auto Approve can help you navigate this process and find the car lease buyout loan that’s right for you.

When you find the best offer for you, it’s simply a matter of getting all of your paperwork in order. The title will be transferred from the dealer to the lender and you will need to check your state’s guidelines on what paperwork you need to complete at the DMV (although if you use Auto Approve for your car lease buyout loan they can handle this paperwork for you) And that’s it! Your leased car is now yours.

Leasing is a great option for many people, but sometimes it’s a good idea to buy your car lease. Whether you want to keep a car that you love, build equity, or simply sell it for a profit, a car lease buyout might be right for you. Contact Auto Approve today to discuss your car lease buyout loan today!