If you are a contract worker, you may not have the same proof of income and employment most people have. This can make financing a car as a self employed person seem more difficult. But if you are prepared and have the right information you can still get a car loan as long as you meet the lender’s requirements.

A 1099 worker, or independent contractor, is a worker who is not employed as a full time employee by a company but instead works for them on a contract basis. Employers will pay them directly and will not through the company payroll system. This means that taxes are not deducted from the contractor’s pay. There are pros and cons to being a contractor and you typically have much more flexibility than you would as a full time worker.

But one significant disadvantage of contract work is that it is not considered to be as stable as full time employment. Contract income can fluctuate greatly from month to month as well, which can make lending a little riskier for a financial institution.

While you may be considered a slightly riskier loan candidate, it is absolutely possible to finance a car as a 1099 worker. While lending requirements vary from lender to lender, in general you should be able to finance a car if you meet the following criteria:

Have a monthly income of at least $1,500 before taxes.

Can make a down payment of at least $1,000 or 10% of the vehicle’s selling price.

Additionally, a good credit score and good debt-to income ratio will help you to secure a loan that has a good car loan interest rate..

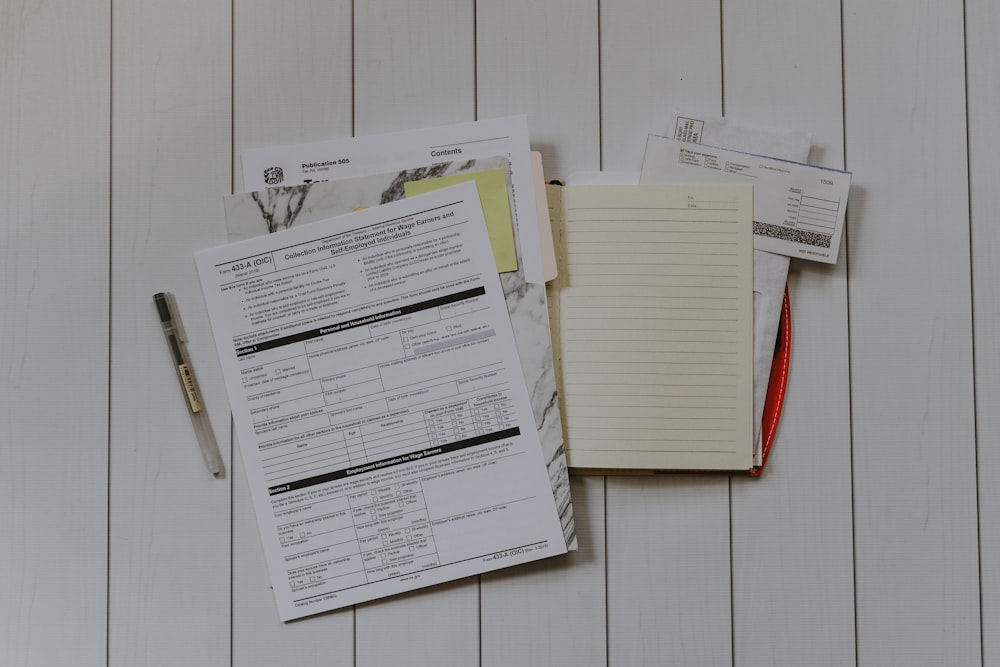

As a 1099 worker you do not have paycheck stubs that are typically required by lenders. These stubs prove that you not only have a steady job, but that you make enough money to afford the car you are buying. So what can you show a potential lender to prove your income?

Your annual tax return (form 1040) is the most straightforward and legitimate way to prove that you have steady income. Employers are only required to file a 1099 for your work if they have paid you more than $600, which may be an issue if you do a lot of small jobs for different companies. But in general for most contractors a form 1040 is your best bet to prove income and employment.

If you do not have your tax form on hand you can show lenders your 1099 forms. These forms are sent to you yearly by any company that has paid you over $600.

If you do not have a 1099 from a company then a bank statement is the best way to prove your income to a lender. If you have separate accounts for your business and personal life this will be easy to provide, but if they are tangled up you will need to go through and sort out which expenses are personal and which are business.

You can actually create a pay stub for yourself that will count as proof of income, so long as you include the following information:

Name and address of the company you provided services for.

Your job title.

Number of hours worked during the pay period.

Your gross pay. This is the total amount received for your work.

Deductions. You will need to calculate and deduct the following from your pay stub: state federal taxes, state and local taxes, social security, and Medicare.

Your net pay. This is the final amount you earned after deductions.

If you have worked with a particular employer for a while it might be a good idea to ask them to write you an employer verification letter. This letter will show that you make money and have a good relationship and history with your employer.

Getting a car loan as a 1099 worker is almost identical to the process for a W2 worker. As long as you are organized and have your proof of income ready you should not have a problem applying for a car loan. The basic steps are the same:

Gather your documents.

Compare lenders.

Apply.

Sign and Drive.

But as we mentioned before, 1099 workers are considered riskier lenders than regularly employed people. Here are a few tips on how to get the best car loan rate when buying a new car.

We always recommend a down payment when buying a car. A down payment of at least 10% (but preferably 20%) will help keep your monthly loan payments to a more manageable amount, get you a better car loan interest rate, and will help to make sure your loan doesn’t end up underwater. But making an even larger down payment will help you even more. Your interest rate will decrease as your down payment increases as the lender becomes more and more confident in your repayment.

Again, we always recommend this, but lender requirements for 1099 workers will vary greatly from bank to bank so it’s even more important to shop around when you are a contractor. While you won’t find loans that are specifically designed for 1099 workers, you will find that certain lenders will work with you more than others.

A good credit score will prove to the lender that you are responsible with your money and have a history of paying your bills on time. Taking the time to pay down high interest debts, enrolling in autopay to make sure you never miss a payment, and requesting higher limits on your accounts will all help to boost your credit score and earn you a better car loan interest rate.

Contract work offers a lot of control and flexibility, but there are certain disadvantages that come with it. Proving employment can take a little more work, but if you are organized and keep track of your income and expenses you should have no problem securing a car loan.

If you are overpaying on your car loan consider refinancing with Auto Approve. Get in touch today to find out home much money you could be saving!